GST Service

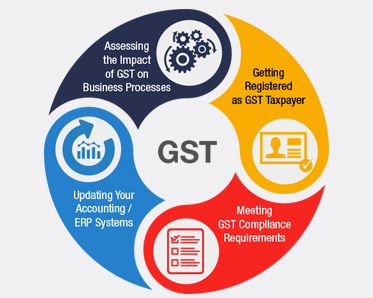

GST is an indirect tax levy subsuming all central and state taxes. It is levied at all stages right from manufacture up to the final consumption with credit of taxes paid at all stages. India adopted a dual GST model where Central and State Governments will simultaneously levy GST on a common tax base.

Features of GST are it is an Origin based tax to destination based tax. The taxable event in GST is supply. It has been declared to operate both Central GST (CGST) and State GST (SGST) on intra state supplies concurrently. In interstate supplies Integrated GST (IGST) will be levied. In exports to outside the country there will be no GST applicable. But for Imports both Basic Customs Duty (BCD) and IGST will be levied.

- Impact Assessment on Taxation

- Assessment on Cash Flow, Working Capital & Transitional provisions

- Impact Assessment on ERP/Accounting systems & Recommendation

- Transition Support to adopt the new tax regime

- Review and filing of returns GSTR & Compliance

- Selection of GSP & ASP tools for uploading the transactions to GSTN portal